Top 10 Best 4WD Cars of 2023 in Australia For Off-Road Adventures

For those keen on taming the rough terrain of the Australian bush or seeking the thrill of an off-road adventure, the 2023 Australian 4x4 market presents an exciting array of the best 4WD cars engineered to meet these demands. As a nation with a landscape that beckons the adventurous spirit, Australians have always favoured vehicles that offer the reliability and robustness to explore the vast and often challenging outback. The year 2023 ushers in a new era for 4WD enthusiasts, with manufacturers rolling out top 4WD vehicles that promise to elevate the off-roader experience to unprecedented levels. In this exploration, we delve into the list of the top machines that combine luxury, performance, and all-terrain capability, ensuring your next adventure is nothing short of extraordinary.

Key Takeaways

- In-depth analysis of the best 4wd cars 2023, poised to dominate the Australian landscape.

- Insight into the top 4wd vehicles crafted for both off-road adventure junkies and family escapades.

- Examination of how these cars handle rugged terrain, providing safety and comfort.

- An overview of the latest trends and technological advancements in the Australian 4x4 market.

- Comparison of new entrants and established heavyweights in the 4WD space.

About the Australian 4WD SUV Market

The Australian 4WD market is a dynamic and ever-evolving landscape, deeply rooted in the nation's love for the great outdoors and the rugged Australian terrain. Enthusiasts and families alike seek vehicles that not only provide the reliability and sturdiness required to traverse tough conditions but also offer the comfort and amenities for daily driving. The market has long been dominated by well-established models such as the Toyota LandCruiser, renowned for its off-road prowess, and until recently, the Nissan Patrol, which has been sidelined from this year's top rankings due to a lack of significant updates.

As we roll into 2023 4wd trends, the industry is keeping pace with the growing demand for dual-purpose vehicles—those that can take on school runs during the week and transform into adventure companions during the weekend. The expanded range of new 4WDs in Australia also means customers can choose between diesel engines, hybrid and electric models.

The burgeoning interest in four-wheel driving experiences shows no signs of waning, and the Australian market is poised to offer a swathe of options that cater to the adventurous spirit ingrained in its culture. It's a reflection of a lifestyle that celebrates natural exploration and the freedom to chart one’s own path, no matter how beaten the road might be.

What we look for when picking the 10 best 4WDs

When putting together the list of the best 4WDs, we focus on a combination of performance, versatility, durability, and features. We look for vehicles that can handle a variety of terrains with ease, from rocky trails to sandy dunes. A strong engine and capable 4WD system are essential, as well as advanced off-road technology like locking differentials and hill descent control. We also consider the comfort and convenience features offered, such as spacious interiors, advanced infotainment systems, and modern safety features. Reliability and overall value for the cost are also important factors in our selection process, ensuring that the 4WDs we choose are not only capable but also practical for everyday use.

Emerging 4WD Vehicles In Australia

As the Australian 4WD market evolves, it's witnessing the introduction of noteworthy players poised to challenge the status quo. Among the fresh faces aiming to impact the off-road family car arena this year, we see the emergence of robust contenders with both performance and value on their minds.

Mahindra's Entry with Scorpio-N

Mahindra takes a competitive leap into the off-road SUV domain with the Scorpio-N, a vehicle that radiates ambition to serve as a Toyota LandCruiser Prado competitor. Armed with a ladder-frame chassis and a comprehensive four-wheel drive system, the Scorpio-N is not only designed to tackle unforgiving terrains but also to appeal to families looking for an adventure-ready vehicle sans the hefty price tag. Considered one of the anticipated off-road family SUVs, it spells practicality without compromising on the thrill of exploration.

GWM Tank 300

3 reasons why we love the GWM Tank 300:

- It's powered by a 2.0-litre turbo-charged petrol engine that provides a smooth and powerful ride.

- The vehicle boasts a bold dashboard design and luxurious trimmings, even in the entry-level model.

- It merges the power of a petrol engine with an electric motor, offering an impressive hybrid model.

The GWM Tank 300 is a mid-size SUV produced by Great Wall Motors. It's powered by a 2.0-litre turbo-charged petrol engine, known from other Wey models, providing an output of 167 kW (224 hp; 227 PS) and peak torque at 387 N⋅m. This powertrain allows the vehicle to accelerate from 0 to 100 km/h in ten seconds, with a maximum speed of 170 km/h. On the inside, the Tank 300 boasts a bold dashboard design and comfortable seats, with luxurious trimmings present even in the entry-level model. The dual-screen infotainment system is a standout feature, taking clear inspiration from the Mercedes-Benz world.

For those interested in a hybrid model, the Tank 300 Lux Hybrid combines the 2.0-litre turbo four-cylinder petrol engine with an electric motor, setting a new standard for 4x4 off-roaders. The body styling of the 2023 GWM Tank 300 is said to be inspired by old-school Jeep, making it a unique blend of classic and modern design elements.

Great Wall Motors is set to shake the Australian 4WD landscape with its GWM Tank 300. This newcomer is generating buzz as a formidable rival to the established Jeep Wrangler and endeavours to deliver a compelling mix of off-road abilities and everyday usability. If Great Wall Motors' past successes are anything to go by, the Tank 300 has the potential to etch its name in the history of iconic off-road SUVs.

Jeep Grand Cherokee 4xe - Pioneering Hybrid Off-Road Tech

The advent of the Jeep Grand Cherokee 4xe marks a significant milestone for enthusiasts of both innovative automotive technology and off-road adventure. With the motoring landscape in Australia increasingly leaning towards eco-friendly solutions without sacrificing the thrill of rugged terrain driving, the Grand Cherokee 4xe emerges as a paragon of 4wd innovation. Harnessing hybrid technology, this formidable SUV offers a seamless blend of efficiency with its all-electric driving range and formidable off-road performance.

- Combining a 2.0L turbocharged engine with two electric motors, the Grand Cherokee 4xe generates remarkable power while contributing to a cleaner environment.

- An advanced 4xe plug-in hybrid system enables up to 40 kilometres of emissions-free, all-electric driving, offering sufficient range for daily commutes or silent off-road exploration.

- Off-road performance is uncompromised, with Jeep's legendary 4wd capability enhanced by the instant torque delivery from its electric powertrain.

- Technological advancements are not just under the hood; driver-focused innovations such as the Selec-Terrain traction management system adapt to any challenge the Australian landscape throws your way.

The integration of hybrid technology within the Jeep Grand Cherokee 4xe does more than just conserve fuel and reduce emissions. It also elevates the overall driving experience, ensuring that adventures into the unknown are not only more sustainable but also more exhilarating than ever before. It's clear that Jeep's commitment to 4wd innovation continues to establish new benchmarks in the segment, aligning with the values of today's environmentally conscious and adventure-seeking driver.

Nissan Patrol Warrior

3 reasons why we love the Nissan Patrol Warrior:

- It's a powerhouse on wheels with its 5.6-litre V8 engine delivering a whopping 400hp and up to 560Nm of torque, perfect for your off-road adventures or even just showing off in the city.

- The Patrol Warrior has been tuned for performance with a range of tweaks that give it a meaner, more aggressive look. It's not just a car, it's a statement!

- Its lineage is a testament to its quality, being a product of a successful collaboration between Nissan Australia and the automotive engineering consultancy Premcar.

The Nissan Patrol Warrior is a thrilling blend of raw power, bold design, and sophisticated engineering. It's a 4WD that doesn't just get you from A to B, but makes the journey an adventure. This beast of a machine, with its 5.6-liter V8 engine and extensive performance-focused modifications, is a force to be reckoned with, whether you're cruising through the outback or hitting the city streets.

Plus, there's plenty of room for the whole family, so that trip down the Great Ocean Road won't feel cramped. The Nissan Patrol Warrior is more than just a car, it's a lifestyle - for those who dare to drive the extraordinary.

Suzuki Jimny

3 reasons why we love the Suzuki Jimny:

- The Suzuki Jimny is a compact, robust four-wheel drive off-road mini SUV that has been tried and tested since 1970.

- Its K15B engine is lightweight, compact and capable of delivering plenty of torque in low revs—perfect for off-roading.

- It also features advanced safety technology such as sensors that detect potential collisions and alert the driver with an audio warning and visual warning.

The Suzuki Jimny is a legendary off-road mini SUV that's been delighting adventurers since 1970. Despite its compact size, the Jimny is a robust vehicle built for the outdoors, thanks to its K15B engine that delivers an impressive amount of torque, making it perfect for off-roading.

The Jimny is also conscious of safety, equipped with advanced technology like a monocular camera and laser sensor to detect potential collisions and alert the driver accordingly. But don't be fooled by its rugged nature, the Jimny can handle city life too without sacrificing fuel efficiency. Whether you're traversing rough terrain or navigating city streets, the Suzuki Jimny proves to be a versatile, reliable, and fun choice.

Check out our a comprehensive guide on Australia’s fav little 4WD - the Jimny.

Ford Ranger Wildtrak X

3 reasons why we love the Ford Ranger Wildtrak X:

- The Wildtrak X packs power with a choice of a 3.2-liter engine paired with a six-speed automatic, or a 2.0-liter bi-turbo paired with a 10-speed auto, both promising a smooth yet thrilling ride.

- It's built for tough terrains with an increased ground clearance, wider track, and a steel bash plate. The integrated auxiliary LEDs in the unique front grille also enhance off-road driving experiences.

- The full-time four-wheel-drive system, shared with the V6 Ranger and Ford Everest SUV, makes it a reliable and versatile vehicle for various driving conditions.

The Ford Ranger Wildtrak X is a standout in the world of 4WDs. With its powerful engine options, including a 2.0-liter bi-turbo and a 3.2-liter variant, it delivers an exciting and dynamic driving experience.

But it's not just about power, the Wildtrak X is equally adept off-road, boasting a wider track, enhanced ground clearance, and a sturdy steel bash plate. With the added bonus of integrated auxiliary LEDs for better visibility, you're well equipped to tackle the great outdoors.

Mitsubishi Pajero Sport

3 reasons why we love the Mitsubishi Pajero Sport:

- The 2.4-litre turbo-diesel four-cylinder engine is a powerhouse, producing 133kW of power and 430Nm of torque, giving it agile acceleration and heavy hauling ability.

- With a five-star ANCAP rating, it ranks among the safest vehicles on the road.

- Its Super-Select II four-wheel drive system offers a full-time four-wheel drive mode and selectable low- and high-range gearing, providing excellent control and versatility.

The Mitsubishi Pajero Sport 2023 is the perfect companion for any Aussie looking for adventure. Under the hood, you'll find a punchy 2.4-litre turbo-diesel engine that doesn't just offer robust power and torque, but also impressive fuel efficiency. And when it comes to safety, the Pajero Sport has you covered with a five-star ANCAP rating.

One of the standout features of this model is its Super-Select II four-wheel drive system, offering you the control you need for any terrain. And with ample space for the family and luggage, you're all set for that long-awaited road trip. So, if it's power, safety, and versatility you're after, the Pajero Sport 2023 is your go-to 4WD.

Ford Everest - A Family Adventure SUV

3 reasons why we love the Ford Everest:

- Its advanced infotainment system, equipped with SYNC 4A and a 10.1- or 12.0-inch vertical center stack touchscreen, offers a modern and engaging user experience.

- The option of a 2.3-liter EcoBoost gasoline unit or a 2.0-liter EcoBlue turbodiesel engine offers both power and efficiency.

- The Everest provides an excellent balance of ruggedness and luxury, with its tough exterior and comfortable, high-quality interior.

The Ford Everest 2023 is a vehicle that delivers on all fronts, making it an ideal choice for the discerning Aussie adventurer. Equipped with a state-of-the-art infotainment system, it ensures you're connected and entertained on every journey. It offers the choice of a 2.3-liter EcoBoost gasoline unit or a 2.0-liter EcoBlue turbodiesel engine, ensuring robust performance alongside fuel efficiency.

But what truly sets the Everest apart is its blend of rugged capability and interior comfort. Its exterior is designed to withstand the harshest of conditions, while the inside is a sanctuary of luxury and comfort. So, if you're after an SUV that doesn't compromise on power, comfort, or technology, the Ford Everest 2023 is a choice you won't regret.

Land Rover Defender - Conquering New Frontiers

3 reasons why we love the Land Rover Defender:

- The Land Rover Discovery is a true workhorse. It's comfortable to drive on long trips and can tow up to 3,500kg, making it a great choice for families who love to go camping or caravanning.

- The Land Rover Discovery is incredibly versatile. It can be configured to seat up to seven people, making it the perfect car for larger families.

- The Land Rover Discovery is packed with technology. It comes with a variety of standard features including a touchscreen infotainment system, rear-view camera, lane departure warning and automatic emergency braking.

Redefining luxury in the off-road vehicle segment, the Land Rover Defender emerges as a shining beacon for those who covet modern refinement and all-terrain prowess. Its innovative off-road technology, bolstered by a sophisticated air suspension system, allows drivers to effortlessly transition from urban landscapes to rugged trails. This vehicle isn't just about the capability; it's also about providing an opulent experience, making even the most challenging terrain feel conquered. Though it comes at a reasonably high price point, starting at $71,500 for the 2021 model, you’re absolutely getting what you pay for.

Mazda BT-50

3 reasons why we love the Mazda BT-50:

- It's designed with Mazda's unique Kodo Design language, giving it a confident, planted stance that projects strength, capability, and uncompromising quality.

- Powered by a robust 3.0-litre turbo-diesel engine delivering 190PS and 450Nm, the BT-50 is ready for whatever challenges lie ahead.

- It boasts a 5-Star ANCAP safety rating, making it one of the safest utes out there.

Imagine taking the whole family on a road trip in the Mazda BT-50. This is no ordinary 4WD; it's a robust and reliable vehicle that speaks volumes about strength and quality. Under the bonnet, you'll find a potent 3.0-litre turbo-diesel engine that doesn't shy away from rough terrains or challenging conditions.

But what really sets the BT-50 apart is its impeccable safety record. With its 5-Star ANCAP safety rating, you can be assured that your loved ones are protected throughout your journey. Its distinctive exterior, inspired by Mazda's Kodo Design language, is sure to turn heads wherever you go. So, pack your bags and prepare for an unforgettable adventure with the Mazda BT-50.

Best 4WD Classics You Might Also Love

Toyota Land Cruiser 4x4

No self-respecting list on 4WDs would be complete without a shoutout to the Toyota Land Cruiser, another four-wheel drive with exceptional off-road capabilities. Starting at $60,830, the Land Cruiser is built like a tank and is known for its excellent long-term reliability. Its relatively simple design means that there’s a lot of room for aftermarket modifications if that’s something you’re interested in.

Land Rover Discovery

Next up is the Land Rover Discovery, a four-wheel drive that has continued to gain popularity amongst Aussies since its initial launch in the country in 1991. Complete with all of the latest safety features and technology, this iconic model has enjoyed decades of popularity for a good reason. The Land Rover Discovery starts at $101,875, and the Land Rover Discovery Sport starts at $66,810.

Jeep Wrangler

Moving on…the Jeep Wrangler, a car that is truly built for the outback. Though it’s not quite as smooth driving around the city, it thrives off-road, whether that’s rock-crawling or dune bashing. The Wrangler starts at $61,750.

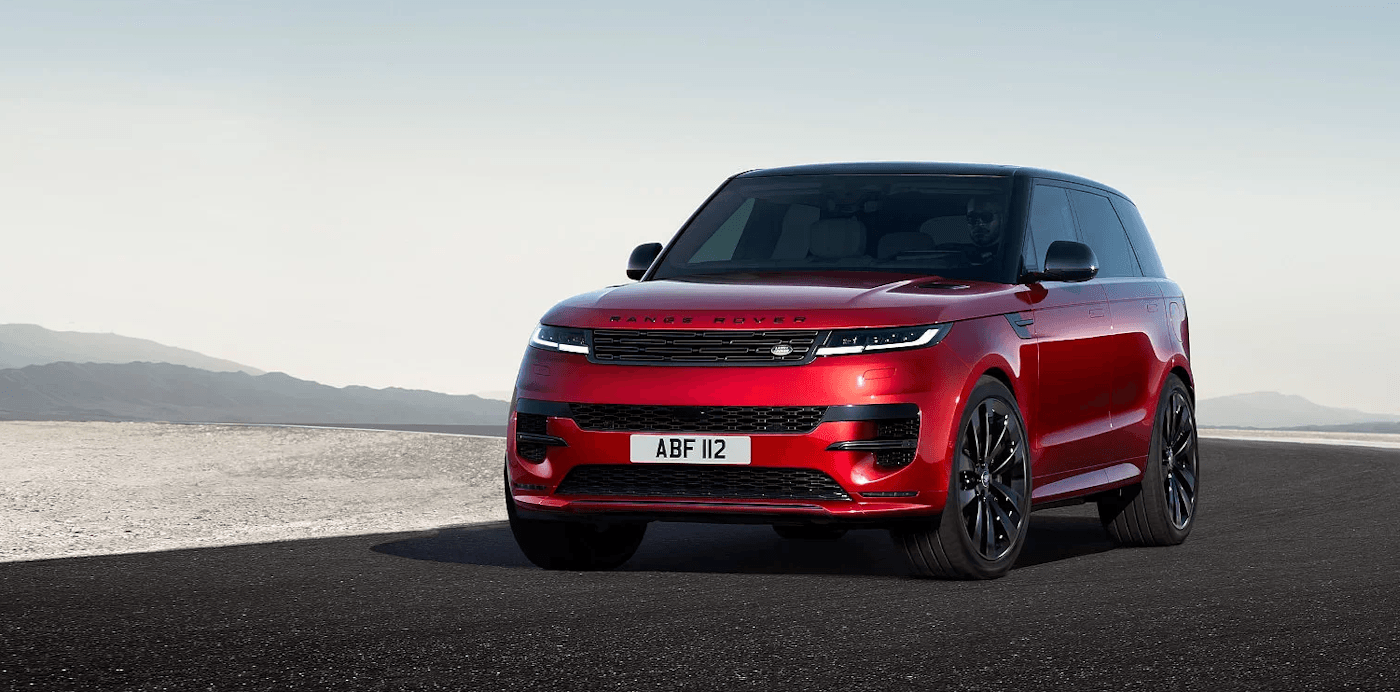

Land Rover Range Rover Sport

Cue Range Rover Sport, one of the most popular luxury SUVs on the Australian market. This four-wheel drive is as sleek as it is capable and comes in a variety of models to suit all different driving styles. The Range Rover starts at $115,506 drive away.

Ford Ranger Raptor

The Ford Ranger Raptor comes is loved for its smooth performance and extraordinary reliability. With impressive off-road credentials and the capacity to deliver an excellent ride quality regardless of the terrain, the Ford Ranger Raptor is an incredibly capable 4WD ute that starts at $79,390.

Land Rover Defender

And last but not least…the Land Rover Defender, an iconic, capable and unstoppable four-wheel drive that thrives on-road and off. Though it comes at a reasonably high price point, starting at $71,500 for the 2021 model, you’re absolutely getting what you pay for. Featuring a stunning cabin design and sleek exterior, the Land Rover Defender is undoubtedly our favourite 4WD of 2021.

Final Thoughts

From the urban sprawl to the rugged Australian outback, 2023’s lineup of 4WDs promises a vehicle for every adventure. Whether you're seeking a family car, a commercial vehicle, or a big off-road SUV, the Australian market has something to offer. Fuel efficiency, off-road ability, and safety features are all part of the mix, ensuring that your new car is ready for any journey.

Choosing a 4WD in 2023 is more than just selecting a vehicle; it's about choosing a partner for exploration and reliability. With top 4wd purchases this year, we witness the enduring durability of the Mitsubishi Pajero Sport, the enviable all-terrain command of the Land Rover Defender, and even the sumptuous indulgence offered by the Porsche 911 Dakar. Coupled with this is the advent of hybrid and electric models that promise eco-friendly excursions without foregoing grit and fortitude.

If you'd like to explore smaller vehicle options, we have a list of the best small cars money can buy.

How Driva Can Help Finance Your New Car Purchase

If you're looking to buy a new 4WD or a small car, Driva can help finance your new car purchase. With Driva, you can get personalised car loan quotes in just a few clicks without any impact on your credit score. You can compare offers from 30+ lenders and receive the best loan match in just a few clicks.

When buying a new car, it's important to find the best financing option, and Driva can help you do just that. Plus, with Driva, there are no hidden fees or surprises, so you can confidently drive away in your new car without any financial stress. Check out Driva and get started on finding the best financing option for your new car purchase.

Got questions?

What are the key features of the Toyota LandCruiser 4WD SUV coming in 2023?

The Toyota LandCruiser 4WD SUV coming in 2023 boasts advanced diesel engines, versatile suspension, and superior off-road capabilities, making it one of the best 4x4s for off-road adventures and light-commercial use.

What should I look for when buying a 4WD vehicle in Australia?

When buying a 4WD vehicle in Australia, it's important to consider factors such as towing capacity, axle configuration, off-road capabilities, and the availability of full-time 4WD systems to ensure it meets your off-road adventure needs.

Are there any new 4WD SUVs arriving in 2024 in Australia?

Yes, several new 4WD SUV models are arriving in 2024 in Australia, such as the Suzuki Jimny XL, Ford Bronco and 2024 Jeep Grand Cherokee L.

What is the best 4WD Australia has to offer for towing?

For towing, the Ford Ranger Raptor is arguably the best 4WD Australia has to offer. Its diesel engine and robust construction, coupled with a high towing capacity, make it ideal for hauling heavy loads.

Do 4WDs have higher on-road costs than other vehicles?

Yes, 4WDs typically have higher on-road costs than other vehicles. This can be attributed to factors such as fuel efficiency, car finance terms, and maintenance of off-road functions and safety systems.

What makes a 4WD vehicle a great choice for off-road adventures in Australia?

4WD vehicles are a great choice for cross-country adventures in Australia due to their versatile off-road abilities, ability to handle challenging terrain, and advanced features like off-road cruise control, making them ideal for exploring rugged landscapes.

Can 4WD vehicles be used as both off-roaders and light-commercial vehicles in Australia?

Yes, 4WD vehicles are suitable for both off-road adventures and light-commercial purposes in Australia, offering the versatility to handle rugged terrains while also providing practical utility for carrying cargo and equipment in commercial settings.

.jpeg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C800%2C800&w=500&h=500)