Take control of your spending by refinancing your car loan

Car loans are a fixed rate product, which means interest rates and monthly repayments stay the same over a predetermined amount of time. But that doesn’t mean you’re not eligible for a better deal.

Consumers should evaluate if refinancing their car loan can help them save money or better manage monthly repayments, especially if circumstances have changed (for better or worse). Refinancing can also help you take advantage of today’s record low interest rate environment.

Here’s how refinancing works, when you should apply, and how to calculate your savings:

What is refinancing and how does it work?

When you refinance, you replace an existing loan with a new loan. This new loan pays off the debt of the old loan, and should have better terms or features that improve the overall cost of the loan.

When you refinance a vehicle with Driva, your chosen lender pays off the old loan directly to your original lender, and the new lender takes security over the same vehicle.

All you’ll need to provide is the original loan balance and term, age of the vehicle and up to date bank statements and payslips and your new lender takes care of the rest.

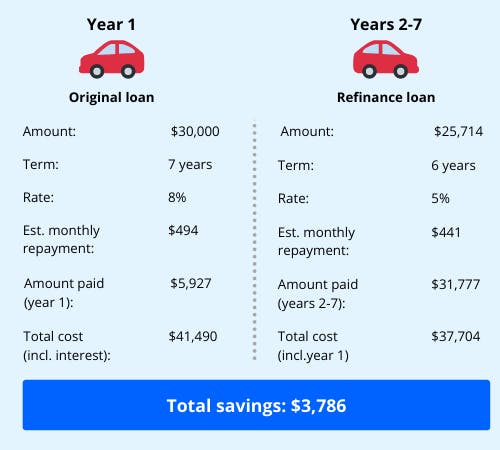

Consider a customer that takes out a $30,000 loan over a 7 year period, at an interest rate of 8%. Including all fees and charges, this customer has a monthly repayment of $494 per month, which over the course of 7 years would amount to $41,490.

After one year, this customer discovers their lender has dropped their interest rate and they are now eligible for a 5% loan, so they decide to refinance. Their new monthly repayment amount is $441, which over the course of 6 years amounts to $31,777.

The total amount this customer pays over the 7 year period is $37,704, which is the sum of the first year of payment under the original loan and the next six years of payments under the refinancing loan.

This means that the customer saves $3,786, which is the difference between what they would have paid under the original loan ($41,490) and what they ended up paying across the two loans ($37,704).

Why refinance?

As illustrated above, refinancing can save consumers a considerable amount, so it’s important to evaluate whether refinancing could help manage your finances.

Here’s four reasons why refinancing might make sense for you.

1. Interest rates have dropped

Unlike mortgages which often have an interest rate that varies over time, car loans are a fixed rate product. This means that when a lender drops their rates, your monthly repayments remain unchanged.

That’s why if you already have an existing car loan and want to make the most of lower interest rates, you’ll need to refinance.

The RBA cash rate is at historical lows, and two of Driva’s main lenders dropped their rates last week, so now might be a good time to re-evaluate what your best rate is.

2. You didn’t get a great deal the first time round

Sometimes the excitement of a new vehicle or hassle of shopping around means you didn’t get the best rate for you at the time of your car purchase.

While your existing lender won’t change the rate for you, it doesn’t mean you’re stuck with that rate for the rest of the loan.

If you think you’re paying too much on your existing car loan, now could be a good time to see your best car loan offers.

Just be sure to check any fees associated with early payment of your existing loan before paying it out the existing loan in full.

3. Your credit score has improved

If you think your credit score has improved since you first took out your car loan, you might be eligible for improved interest rates.

Inquiries on your credit file or defaults are only recorded for 5 years, so if enough time has passed your score might have improved dramatically. Consistently meeting your repayments on time is also a huge driver of credit scores. For example, if you now have a few years of mortgage repayments on your credit file but didn’t when you first took out your car loan, a lender will give you a much better rate today then what you were offered when you locked in your fixed rate loan.

There are a number of factors that impact your credit score, and you should be sure to use one of the many free credit score tools to monitor how yours has changed over time.

4. Your struggling to meet your monthly repayments

Circumstances change all the time, and not always for the best. Particularly as we navigate the consequences of the unfolding COVID-19 outbreak, you might be finding it increasingly difficult to keep up with your monthly repayments.

Refinancing a loan over a longer loan term will mean you have lower monthly repayments, which will make meeting your monthly expenses less of a challenge.

But keep in mind the longer your loan the longer you’re paying interest, so carefully consider what your total loan cost is before committing to the refinancing.

Next steps

Refinancing can save you money in interest or stretch out your loan payments, and is a great tool for consumers who think they can get a better deal on their car loan. But they should only be used when circumstances are right, and the new loan has more favourable terms than the old loan.

Driva’s smart refinancing platform matches your financing needs with our panel of 30+ lenders to find your best eligible rate.

Simply select “I want to refinance my vehicle” and we’ll tell you how much you could be saving!