Introducing Driva | We're doubling down on cars

We created Jump Payments in 2019 because we experienced first hand just how broken the car financing experience was. The lack of transparency around the true cost of taking out a specific loan, the misleading sales tactics by some in the industry and just how difficult it is for each customer to find their best loan option, inspired us to take the plunge.

While we knew car finance was the starting point, we also suspected that similar problems may exist in other consumer finance products (e.g., mortgages, business loans, etc.).

However, the more we grew, the more customers we served, and the more deeply we understood that the car-buying experience as a whole was where Australians were facing the most frustrations and challenges.

This is how we knew we had to focus 100% on the auto industry, and that we needed a new brand to reflect this.

Car finance is a full time job

Our first 100+ customers confirmed what we felt we already knew, buying a car is a long and painful process. While car finance is just one piece of this process, it is more often than not the biggest challenge for customers and can make or break the car buying experience. We realised it deserved our undivided attention.

With lenders changing their pricing and policies constantly, it’s not enough to be talking to lenders all day everyday. You have to be talking to lenders about car finance all day everyday. It’s a full time job to keep the platform up to date, but this focus is essential to ensure it can enable our customers to make the most informed (and pain-free!) decisions when choosing a lender.

Car finance is just one piece of the puzzle...

We’ve already created a customer experience that we’re incredibly proud of. But we also learned that car finance is just one small piece of the incredibly fragmented car-buying puzzle.

You’ve still got to navigate insurance (compulsory and comprehensive), test drives, negotiations with sales staff, accessories, after-purchase care… the list goes on.

And none of this is easy, particularly if you’re subject to the tactics that one of our customers was just last month (we want to protect her real name, but we’ll call her Amy for this post):

…Yesterday was a horrible day I've never experienced anything like this before purely because I chose a different finance company. I'm not usually one for conflict either so I'm really not used to this. I really just need time to not think about it or even talk about it… The panic attack yesterday was bad and I figured I just need to look after my health... Basically they threatened to sue me if I didn't sign the new contract and that pushed me over the edge…

Jump Customer

What Amy dealt with was extreme, but surprisingly common.

What we learned from customers like Amy is that even if we can make the car financing journey completely pain-free, a predatory car salesman or pushy insurance broker can quickly ruin the entire experience.

That’s why along with a re-brand, we’re now also helping customers navigate the hunt for the perfect new car or comprehensive insurance policy (You can check out Driva’s full product offering here). While these complimentary services are just in their infancy, we’ve got a bunch of exciting new products in the works that we can’t wait to share with you.

Driva makes car buying transparent, responsive and empowering

In line with our promise to remain focused on car buying and our new core values of being transparent, responsive and empowering we’ve made a bunch of changes to our brand.

Key changes

New name

Driva

Our aim is as simple as the name - to make the car buying process fast, simple and transparent to every Australian. We give you the options, so you can make the choice - putting you back in the driver’s seat.

New logo

Our new logo reflects the most important part of what we stand for.

We’re shining a light on the car finance industry, bringing transparency to each individual customer’s best lending option, rates and repayments with nothing hidden. You’ll notice our logo captures the headlight symbol you’d normally see on your car dashboard, to capture this sentiment. Like our process, it is a simple and clear logo.

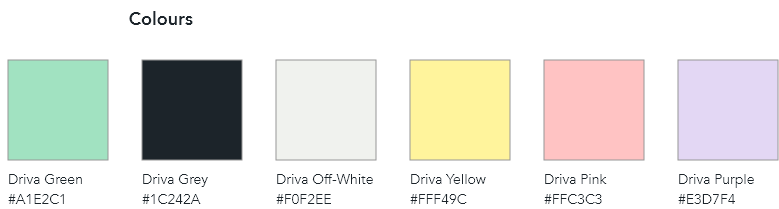

New colour palette

Our colour palette is equally as simple as our logo. Our palette is intentionally different to almost any other lender, dealer or broker you’ll see in the car industry. Driva approaches the car buying experience differently, because that’s what our customers asked for - and our palette reflects this.

Putting you in the Driva’s seat

The 4th of August marks the launch of our new website, logo and colour palette - but it’s the products and features on our road-map that we’re most excited about.

We remain 100% committed to providing the most responsive and empowering financing experience in the Australian market. But you should also expect a bunch of releases that allow for a more seamless car-buying experience end-to-end along the way.

We’d love to hear from you

For any questions or suggestions on our new identity, we’d love to hear from you.

You can find us at hello@driva.com.au or 1300 755 494.