Your Financial Health: Understanding Loan Options for Dental Surgery

Introduction

Maintaining good dental health is essential for a beautiful smile and plays a crucial role in overall well-being. Regular dental check-ups and proper oral hygiene practices are vital for preventing dental issues. However, despite diligent dental care, certain conditions may still require surgical interventions. Dental surgeries include wisdom teeth extractions, dental implants, root canals, and gum surgery. While these surgeries are necessary to restore dental health and prevent further complications, they often have significant financial implications.

The cost of dental surgery in Australia can be a substantial burden for many individuals. Understanding the available loan options can help individuals make informed decisions about financing their dental procedures without compromising their financial stability. In this blog, we will explore various loan options and financial strategies to assist you in making the best choices for your dental health.

Dental Payment Plans in Australia: How Dentists Help You Manage Costs

What are Dental Payment Plans?

Dental payment plans are arrangements offered by some dental clinics in Australia to help patients manage the costs of dental treatments over time. Instead of paying the total amount upfront, patients can spread the expenses over a set period, typically with interest-free or low-interest options.

How Dentists in Australia Offer Payment Plans

Many dentists in Australia provide their in-house dental payment plans. These plans vary in terms and conditions depending on the dental clinic. Some offer interest-free periods, while others charge a low-interest rate on the outstanding balance.

Pros and Cons of Dental Payment Plans

Dental payment plans can be a convenient and flexible option for individuals who may not qualify for traditional loans or prefer an alternative to borrowing. However, it's essential to carefully review the terms and conditions of the payment plan to avoid any unexpected costs or penalties.

Dental Work Expenses in Australia: A Comprehensive Overview

Understanding the Cost of Dental Procedures

The cost of dental procedures in Australia can vary significantly based on several factors. These may include the procedure's complexity, the dental clinic's location, the dentist's experience, and the materials used.

Common Dental Treatments and Associated Costs

Dental treatments can range from routine cleanings and fillings to more complex procedures like dental implants and orthodontic treatments. Each treatment comes with its own set of costs, which can add up over time.

Factors Influencing Dental Treatment Expenses

Several factors can influence the overall cost of dental treatment in Australia. Some of these factors include the type of procedure, the need for specialised equipment, the dentist's expertise, and any additional services required.

Super Access for Dental Work: What You Need to Know

Early Release of Superannuation for Medical Purposes

In certain situations, Australians may be eligible to access their superannuation (super) early to cover medical expenses, including dental work. This option is intended for cases where the treatment is deemed medically necessary and cannot be funded through other means.

Eligibility Criteria for Accessing Super for Dental Work

The Australian Taxation Office (ATO) sets strict criteria for accessing super early for medical purposes. Applicants must meet specific medical conditions and demonstrate that no alternative funding options are available.

Weighing the Pros and Cons of Superannuation Withdrawals

While accessing super for dental work may provide financial relief, it's essential to consider the long-term impact on retirement savings. Withdrawing super early can reduce the overall balance and affect the final retirement income.

Loan Options for Dental Surgery: Making Informed Choices

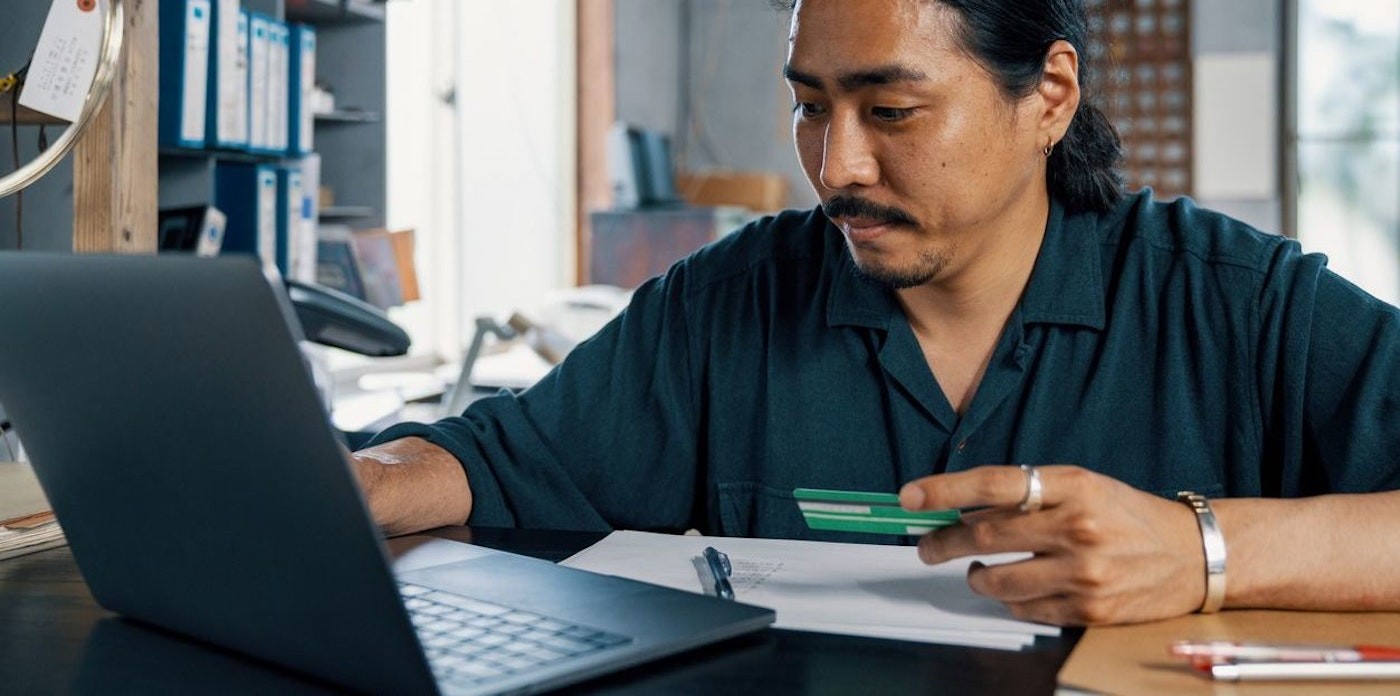

Personal Loans for Dental Surgery

Personal loans are a popular option for financing dental surgery in Australia. They are unsecured loans that can be used for various purposes, including covering medical expenses.

Interest Rates and Terms

Interest rates on personal loans can vary based on the borrower's creditworthiness and the lender's policies. Loan terms may also vary, giving borrowers the flexibility to choose a repayment period that suits their financial situation.

Eligibility and Application Process

Eligibility criteria for personal loans typically include a stable income and a good credit history. The application process involves providing necessary documentation to the lender for assessment.

Medical Credit Cards: A Convenient Financing Tool

Medical credit cards are specifically designed to cover healthcare expenses, including dental treatments. They function similarly to traditional credit cards but with a focus on medical expenses.

Understanding Medical Credit Cards

Medical credit cards often come with promotional offers, such as interest-free periods, to help individuals manage their healthcare costs more effectively.

Benefits and Drawbacks of Medical Credit Cards

Medical credit cards offer convenience and quick access to funds for dental procedures. However, borrowers need to be mindful of interest charges and potential pitfalls if the balance is not paid off within the promotional period.

Dental Financing Plans: Tailored Solutions for Dental Care

In-house Dental Financing Options

Many dental clinics in Australia offer in-house financing options to help patients finance their dental treatments. These plans may come with interest-free periods or low-interest rates.

Third-Party Dental Financing Companies

In addition to in-house financing, some dental clinics partner with third-party financing companies specialising in healthcare loans. These companies offer extended payment options for more expensive dental treatments.

Assessing the Fine Print

Before committing to any dental financing plan, it's crucial to review the terms and conditions carefully. Understanding interest rates, fees, and repayment schedules will help borrowers make informed decisions.

Home Equity Loans and HELOCs: Tapping into Homeownership

Homeowners in Australia may consider leveraging their home equity through home equity loans or home equity lines of credit (HELOCs) to finance dental surgery.

Using Home Equity for Dental Expenses

Home equity loans and HELOCs allow borrowers to access larger loan amounts at potentially lower interest rates. However, it's essential to weigh the risks, as these loans use the property as collateral.

Risks and Considerations of Home Equity Loans

Using home equity for dental expenses carries the risk of losing the property if the borrower defaults on the loan. Homeowners should carefully assess their financial capacity before choosing this option.

Building and Maintaining a Strong Credit Profile

Importance of Credit Scores for Loan Options

Having a strong credit score is essential for accessing favorable loan options and securing lower interest rates. A positive credit history demonstrates responsible financial behavior and enhances an individual's creditworthiness.

Tips to Improve Your Credit Score

For individuals looking to improve their credit score, there are several strategies to follow. Paying bills on time, reducing credit card debt, and reviewing credit reports for errors can help build a healthier credit profile.

How Credit Score Affects Loan Eligibility

A good credit score opens up more loan opportunities and enables borrowers to qualify for loans with better terms. It also plays a significant role in determining interest rates and loan approval.

Seeking Professional Advice: The Value of a Credit Finance Professional

Why Consult a Credit Finance Professional?

Navigating the world of loans and credit can be complex, especially for individuals with little experience in finance. A credit finance professional can offer expert advice and personalised guidance based on an individual's financial situation.

Tailoring Loan Options to Your Financial Situation

Credit finance professionals analyze an individual's financial health and help tailor loan options to suit their specific needs. They take into account factors such as income, credit history, and future financial goals.

Avoiding Common Financial Pitfalls

A credit finance professional can educate borrowers about potential pitfalls and risks associated with certain loan options. This guidance helps individuals make well-informed decisions and avoid financial strain in the long run.

Conclusion

Investing in dental health is an investment in overall well-being. By exploring available loan options, building good credit, and seeking professional advice when needed, Australians can embark on their journey to better dental health with financial peace of mind.

Understanding loan options for dental surgery and seeking expert guidance empowers individuals to choose the most suitable financing solution for their specific dental needs. Whether it's through dental payment plans, personal loans, medical credit cards, or accessing super for dental work, being informed and making informed choices can lead to a healthier smile and a healthier financial future.

At Driva, we specialize in providing dental loans specifically tailored for dental surgeries. With an extensive network of over 30 top-notch lenders, finding your perfect loan match takes just a few minutes. Choosing us as your loan partner ensures a stress-free experience, as we prioritize transparency, offering clear and upfront information about rates and fees. Our seamless 100% online application process lets you apply conveniently from the comfort of your home, making your dental financing journey hassle-free.

.png)