Exploring Types Of Solar Financing Options Available On The Market

Embracing solar power not only contributes to a cleaner environment but also offers significant financial benefits in the long run. In this article, we will delve into various solar financing options available on the Australian market, highlighting the advantages and potential drawbacks of each. By gaining insights into these financing avenues, you can make well-informed decisions about incorporating solar panels into your property.

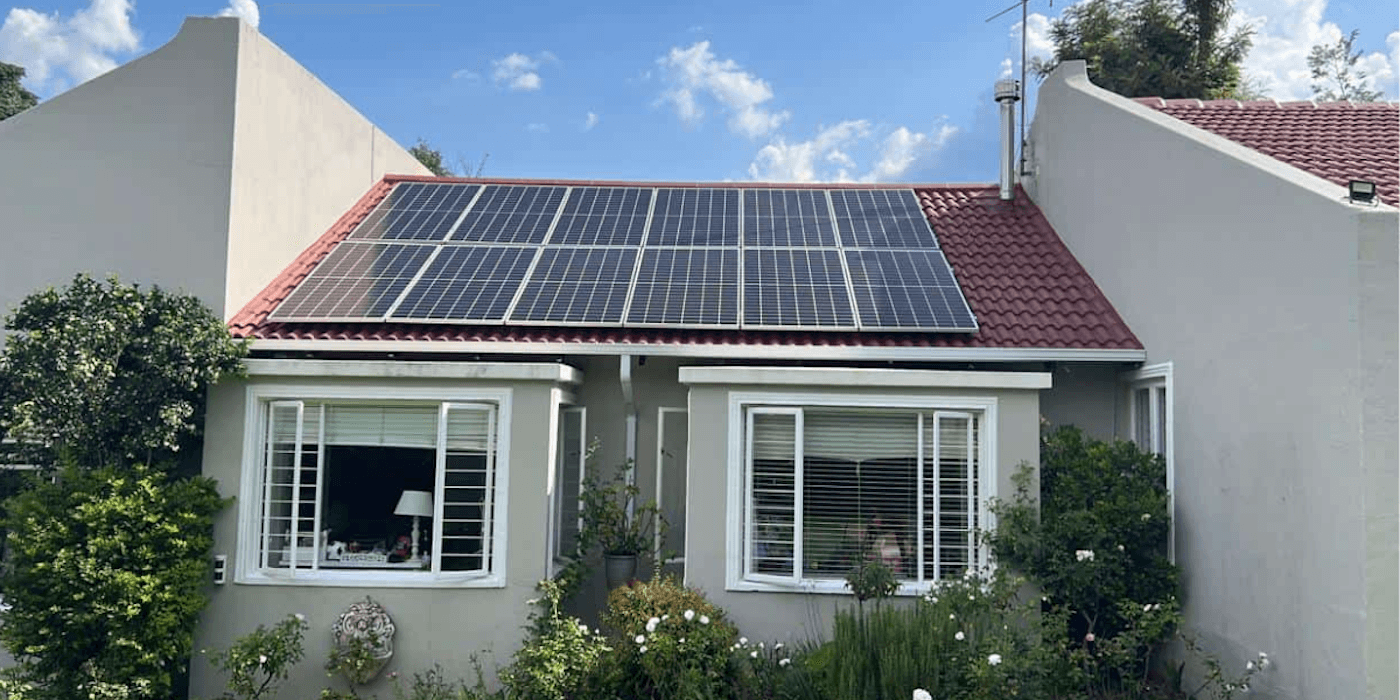

Add Solar Panel Costs to Your Home Mortgage

One of the most convenient ways to finance your solar panels is by adding the costs to your existing home mortgage. This option allows you to spread the expenses over an extended period, making it more manageable for homeowners who may not have the immediate funds available for a cash purchase.

By incorporating solar panel costs into your mortgage, you can take advantage of the low-interest rates that home loans typically offer in Australia. Additionally, you may be eligible for government incentives or rebates, further reducing the overall financial burden.

However, it is essential to consider the potential impact on your home loan's repayment terms and interest expenses. A credit finance professional can help you calculate the long-term cost-effectiveness of this option and ensure it aligns with your financial goals.

Rent to Own Solar Panels

For those who wish to avoid a large upfront payment, the rent-to-own model for solar panels presents an attractive alternative. Under this arrangement, you can lease the solar panels with a fixed monthly fee that goes towards eventual ownership of the system. This option is particularly popular for renters and homeowners with limited financial resources.

The primary advantage of rent-to-own solar panels is the low initial cost, as the installation expenses are typically covered by the solar provider. Additionally, some agreements include maintenance and repairs, reducing the burden of ongoing expenses.

However, it's crucial to consider that the overall cost of rent-to-own arrangements may be higher compared to other financing options. The extended payback period and the fact that you do not fully own the panels until the end of the agreement are aspects to carefully evaluate. Consulting with a credit finance professional can help you assess the long-term financial implications and whether this option aligns with your unique circumstances.

Cash

Paying for solar panels in cash upfront is undoubtedly the most financially advantageous option, as it eliminates interest charges and provides immediate returns on your investment. Australian homeowners who have saved up or have access to significant funds may find this approach appealing.

One of the significant benefits of a cash purchase is the potential for substantial savings on electricity bills over time. Additionally, you won't be tied to monthly financing payments, allowing for greater flexibility in your financial planning.

However, it's crucial to consider the opportunity cost of tying up a substantial amount of cash in solar panels. Assess whether the financial benefits of potential electricity bill savings outweigh the other investment opportunities you could explore with that money. A credit finance professional can provide valuable insights into making this decision and help you optimise your financial strategy.

Green Loans

Australia offers specific financing solutions known as green loans, tailored explicitly for eco-friendly initiatives such as solar panel installations. These loans come with competitive interest rates and favorable terms, making them an attractive option for homeowners looking to embrace solar energy.

The advantages of green loans include the availability of low-interest rates and flexible repayment options, allowing you to spread the cost over a reasonable timeframe. Additionally, some green loans may offer additional benefits, such as no early repayment penalties.

However, green loans are subject to credit approval, and eligibility criteria may vary among lenders. A credit finance professional can help you identify suitable green loan options, evaluate your eligibility, and guide you through the application process.

Interest-Free Solar Loans

For homeowners seeking even more favourable financing terms, some governmental and nonprofit organisations offer interest-free solar loans. These loans provide an excellent opportunity to invest in solar energy without incurring any interest charges, significantly reducing the overall cost.

Interest-free solar loans are often provided to promote renewable energy adoption and help homeowners overcome financial barriers. Additionally, some regions may offer tax incentives or rebates, further enhancing the cost-effectiveness of this financing option.

However, it's important to note that interest-free solar loans may have limitations in terms of availability and qualification criteria. Consulting with a credit finance professional can help you identify these opportunities in your area, assess your eligibility, and guide you through the application process.

Conclusion

In conclusion, exploring the various solar financing options available on the Australian market is crucial for homeowners looking to embrace renewable energy and reduce their carbon footprint. Whether you choose to add solar panel costs to your home mortgage, opt for rent-to-own arrangements, pay in cash, consider green loans, or explore interest-free solar loans, there is a financing option to suit your unique needs.

By leveraging the expertise of a professional and exploring the available solar financing options, you can embark on your solar energy journey with confidence, contributing to a more sustainable future while reaping the financial rewards.

Discover Driva's solar loans and embark on a path to a greener future. With Driva, you can explore a network of 30 plus lenders, compare options, and conveniently apply online. Enjoy the comfort of a transparent process, as Driva values transparency by showing you rates and fees upfront. Take the next step towards solar financing with Driva and embrace a sustainable energy solution.