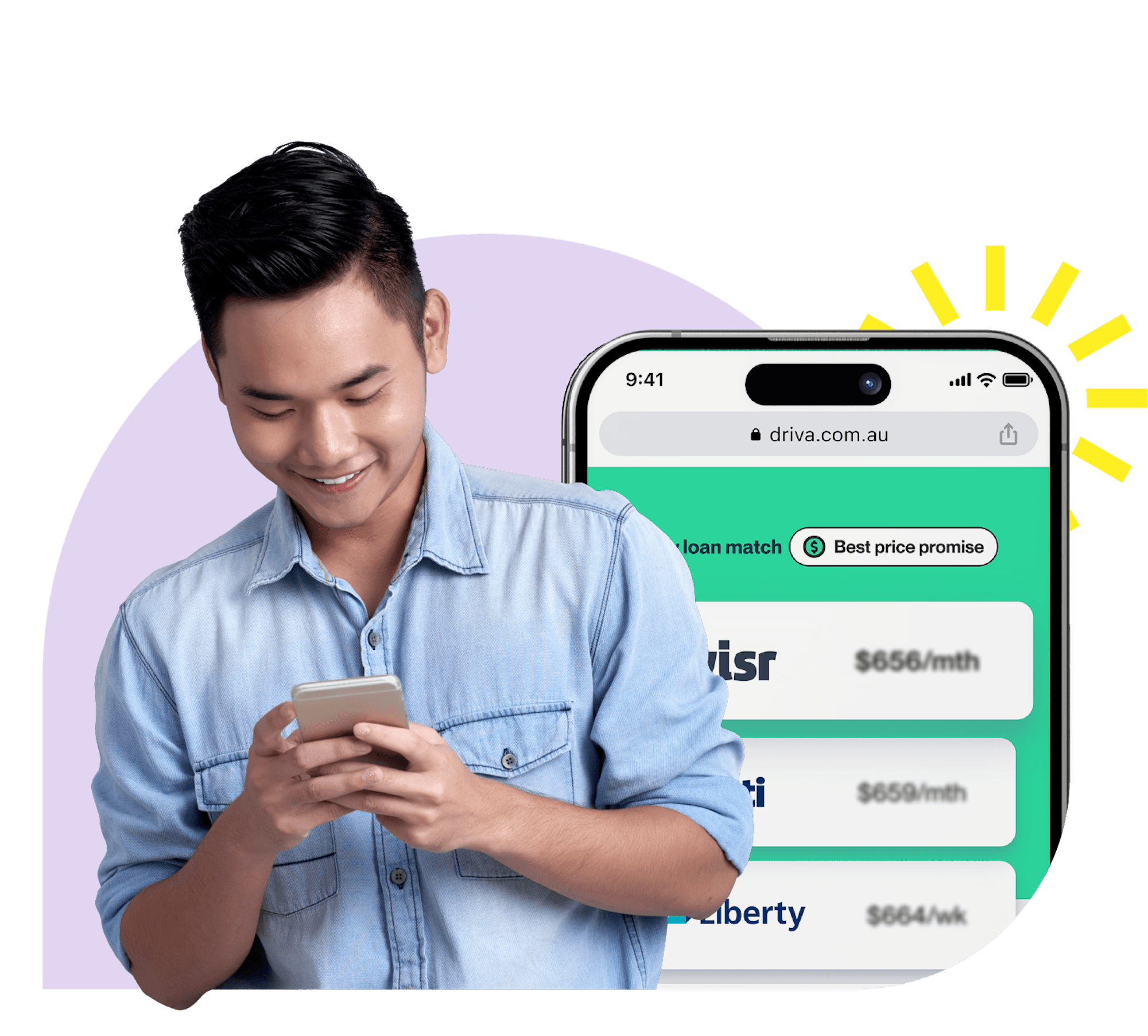

Personalised rates in 60 seconds

Choose your preferred personal or business loan from multiple options, tailored specifically to you

What's wrong with traditional finance?

It's hard

Not only is it a slow and painful process, it’s really hard to shop around and compare rates.

Everything is hidden

Interest rates and fees are generally not shared with the customer. Brokers tend to favour lenders that pay the highest commissions, not those that have the best rates.

It's not personalised

Almost every other finance company uses generic starting rates not specific to you - these rates then change later in the process.

What's right with Driva?

It's easy

We take the hard work out of the loan application process from start to finish.

Nothing is hidden

We're 100% transparent, so there are no hidden surprises.

Personalised

We provide you with personalised rates based on your profile. This means no last minute rate changes just before you sign the contract.

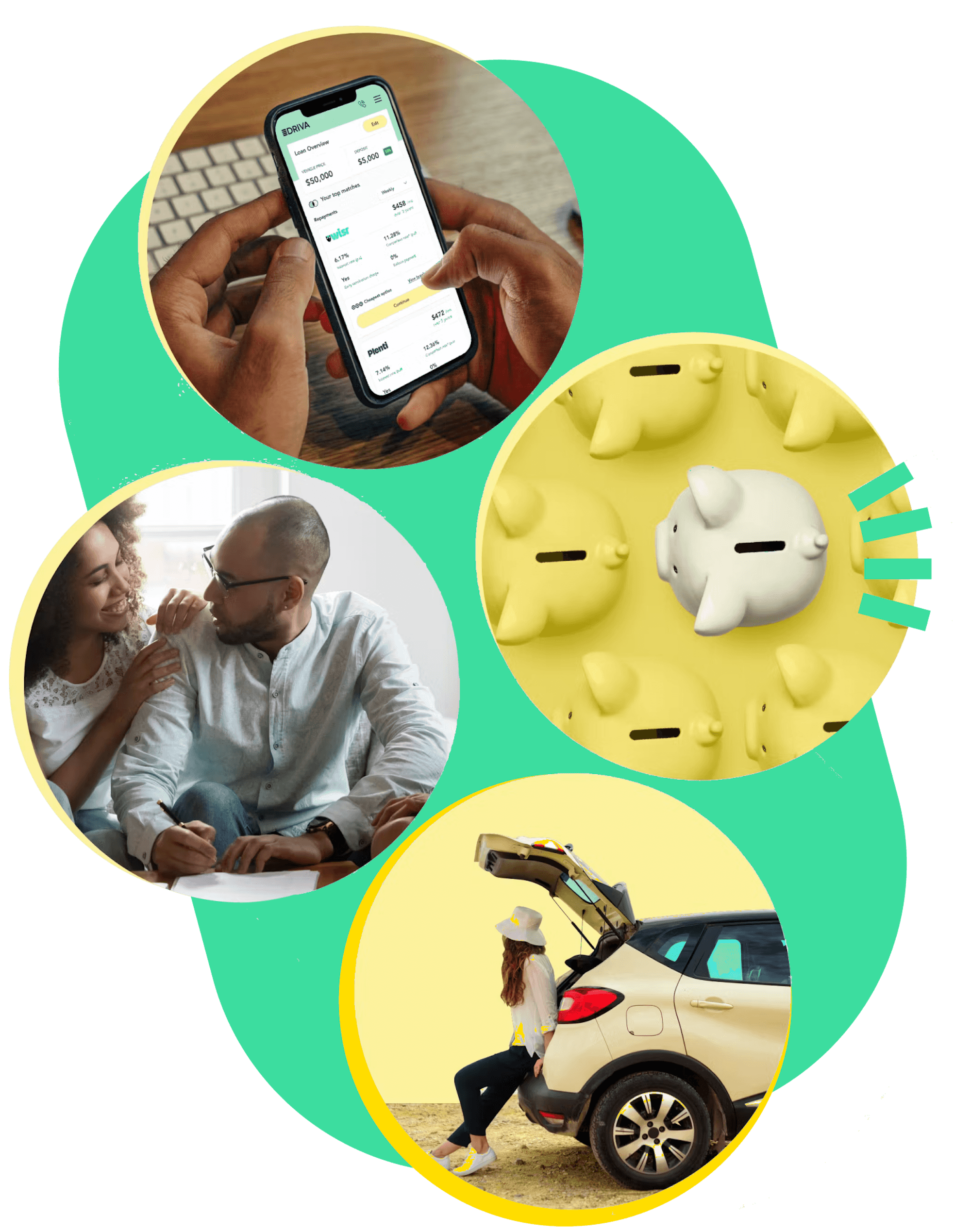

How to get a personalised loan with Driva

1. Smart match

Follow a few simple online steps and we’ll match your personal profile to the best pre-qualified rates - not generic rates that can change later in the process.

2. Choose loan

Choose a preferred lender from your personalised options, with 100% transparency. The options we provide will show all fees, with nothing hidden.

3. We do the checks

We make sure you're likely to be approved before sharing your profile with lenders. This prevents disappointment, protects your credit score and speeds up the process. Getting approved takes from 2 hours to 2 days, depending on your lender.

4. Loan approved!

For secured vehicle loans, once you've found your vehicle of choice, give us vehicle details and proof of insurance details and we'll release funds (subject to loan approval). If you don't know where to start, we can help with that too!

Compare loan rates from over 30 lenders

| Lender | Loan Amount | Loan Term | Interest Rates From | |

|---|---|---|---|---|

| $5,000 - $150,000 | 2-7 years | 6.99% p.a. | |

| $5,000 - $80,000 | 3-7 years | 7.87% p.a. | |

| $5,000 - $100,000 | 2-7 years | 9.15% p.a. | |

| $3,000 - $100,000 | 2-7 years | 9.24% p.a. | |

| $5,000 - $100,000 | 3-5 years | 9.29% p.a. | |

| $5,000 - $150,000 | 1-7 years | 9.44% p.a. | |

| $5,000 - $150,000 | 1-5 years | 9.52% p.a. | |

| $5,000 - $130,000 | 1-5 years | 9.69% p.a. | |

| $10,000 - $100,000 | 2-5 years | 9.95% p.a. | |

| $5,000 - $65,000 | 3-7 years | 10.09% p.a. | |

| $10,000 - $100,000 | 3-7 years | 10.25% p.a. | |

| $5,000 - $100,000 | 1-5 years | 10.25% p.a. | |

| $15,000 - $100,000 | 2-7 years | 10.29% p.a. | |

| $2,000 - $75,000 | 1-7 years | 13.95% p.a. | |

| $2,000 - $40,000 | 2-5 years | 15.75% p.a. |

Start Driva Now