Comprehensive Car Insurance for living, not waiting

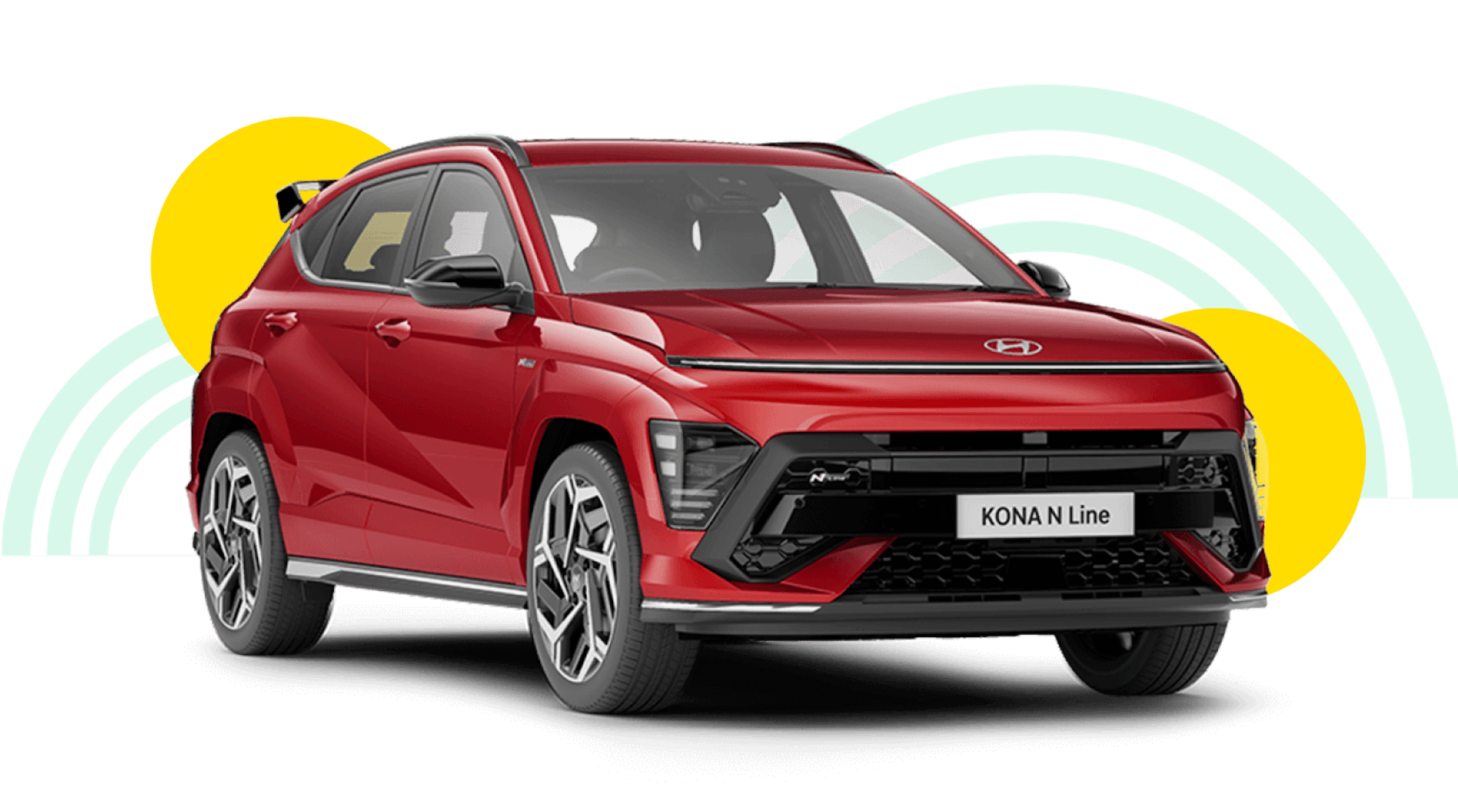

Take out insurance from Huddle for your new car.

Insurance built for modern life

Comprehensive Car Insurance

Liability cover

Up to $20m

New for old replacement

Up to 2 years, if you are the first registered owner

24/7 claims?

Yes

Other features

- Theft and damage cover

- Towing costs cover

- Emergency travel and accommodation up to $500 if 200 kms or more away from home

- Hire car after theft (up to $70 per day for up to 14 days)

- Replacement or recode of car's locks and keys (up to $1000)

- Personal property cover (up to $500)

Huddle Black Comprehensive

Liability

Up to $30m

New for old replacement

Up to 3 years (and if it's travelled less than 70,000 kms)

24/7 claims?

Yes

Other features

- Theft and damage cover

- Choice of repairer

- Towing costs cover

- 24/7 Roadside Assistance

- Emergency travel and accomodation up to $2,000 if 100 kms or more away from home

- Hire car after theft (up to $80 per day for up to 14 days)

- Replacement or recode of car locks and keys (up to $2,000)

- Personal property cover (up to $1,000)

Optional extras (add-ons available for Comprehensive and Huddle Black)

- Excess-free windscreen once a year

- Roadside assistance

- Excess free Kanga cover once a year

- Sports gear cover up to $3,000

Smarter insurance for your car

Don’t take our word for it

We always recommend a second opinion. Read our customer reviews about the Driva finance experience.

Here's some important things you should know

It's important to know what you are covered for. Carefully read Huddle's Product Disclosure Statement (PDS) and consider the relevant Target Market Determination to help you decide if the product is right for you. Exclusions apply

Car Insurance - Product Disclosure Statement

Have a question?

Looking for something else?

© 2024 Driva Pty Ltd. All rights reserved. Driva Pty Ltd ABN 37 635 659 160 (Driva) is a referrer of car insurance issued by Huddle Insurance, a business name of Open Insurance Pty Ltd, ABN 23 166 949 444, AFSL no. 451712 on behalf of the insurer, The Hollard Insurance Company Pty Ltd, ABN 78 090 584 473, AFSL no. 241436. Open acts as an agent of Hollard and not on your behalf. Open will pay Driva a commission of up to 12% of the gross earned premium paid for each policy issued. Exclusions apply. Driva’s commission is included in the total amount you pay. Any advice is general only and does not take into account your personal objectives, financial situation or needs. You should carefully read the relevant Product Disclosure Statement and Financial Services Guide, and consider the relevant Target Market Determination to help you decide if the product is right for you. Eligibility criteria apply.

1. Saving of up to 30% derived from premium comparisons between Huddle unlimited kilometre comprehensive car cover option and Huddle Pay As You Drive comprehensive car cover option. Calculations based on a sample of profiles of existing Huddle car insurance customers who advised they drive under 15,000 km annually. Current as at 9 May 2024. Actual savings are determined by your individual circumstances, including the kilometres selected, excess chosen and other risk factors. Minimum premiums may reduce savings. Kilometres can be increased during the policy period, an additional premium is payable. In the event of an accident and the end odometer reading is exceeded or is below the start odometer reading on your Certificate of Insurance, an additional excess is applied.