Effective Debt Consolidation Strategies for Tackling Large Debts

Dealing with large debts can be overwhelming and stressful. As a credit finance professional, I understand the challenges faced by individuals in Australia who are burdened by significant debt. Fortunately, effective debt consolidation strategies can provide relief and pave the way toward financial freedom. In this article, we will explore the concept of debt consolidation and explore various strategies to help Australians tackle their debts efficiently and regain control over their finances.

Understanding the Concept of Debt Consolidation

Debt consolidation refers to combining multiple debts into a single loan or payment plan. It aims to simplify the repayment process and make it more manageable for individuals struggling with various creditors and payment schedules. In Australia, several debt consolidation options are available, each with pros and cons.

One popular method is a balance transfer, where individuals transfer their high-interest credit card debts to a new card with a lower interest rate. This can result in significant interest savings, allowing individuals to pay off their debts more efficiently. Debt consolidation loans are another option, where individuals take out a loan to pay off their existing debts, consolidating them into a single monthly payment. Home equity loans or lines of credit, as well as personal loans, can also be used for debt consolidation purposes. Additionally, debt management programs offered by reputable agencies can help negotiate with creditors and establish a structured repayment plan.

Assessing Your Debt Situation

Before embarking on a debt consolidation journey, assessing your current debt situation thoroughly is crucial. Start by determining the total amount of debt you owe. Compile a comprehensive list of all outstanding balances, including credit cards, personal loans, and any other debts you may have. It is essential to clearly understand the magnitude of your debts.

Next, evaluate the interest rates and repayment terms of each debt. This information will help you identify the debts costing you the most and prioritise their consolidation. Additionally, consider the types of debts you have. For example, consolidating high-interest credit card debts may take precedence over consolidating low-interest student loans. Finally, analyze your financial capability to repay the consolidated debt. Consider your income, expenses, and any potential changes in your financial circumstances.

Creating a Debt Consolidation Plan

To effectively tackle your debts, creating a well-thought-out debt consolidation plan is crucial. Start by setting clear financial goals. Determine what you want to achieve through debt consolidation – reducing interest payments, simplifying repayment, or improving your credit score. Setting specific goals will help you stay focused and motivated throughout the process.

Research and compare different debt consolidation options available to Australians. Each option has its terms, requirements, and potential financial impact. Consider interest rates, repayment terms, fees, and eligibility criteria. It may be beneficial to consult with a credit finance professional who can provide personalised advice based on your specific circumstances.

Once you have chosen the most suitable debt consolidation method, calculate its potential savings and costs. Compare the total interest payments, monthly payments, and overall repayment period between your current and consolidated debt debts. This analysis will help you determine whether debt consolidation is a financially viable option for you.

Implementing Debt Consolidation Strategies

Once you have devised your debt consolidation plan, it's time to implement it. Here are some strategies you can implement to consolidate your debts effectively:

Applying for a Debt Consolidation Loan or Credit Line

If you opt for a debt consolidation loan, start by researching and comparing different lenders in Australia. Look for lenders offering competitive interest rates, favorable repayment terms, and minimal fees. It is advisable to approach reputable financial institutions and credit unions to ensure the security and reliability of your loan.

Transferring Balances to Lower-Interest Credit Cards

Balance transfers can be an effective strategy to consolidate credit card debts. Look for credit card providers offering introductory zero or low-interest rates on balance transfers. Be mindful of any transfer fees and the duration of the introductory period. Transfer your high-interest credit card balances to the new card and make a plan to pay off the consolidated debt within the interest-free period.

Seeking Assistance from a Reputable Debt Management Agency

Debt management agencies can provide valuable assistance in consolidating your debts. These agencies work on behalf of individuals to negotiate with creditors for better repayment terms. They can help you establish a structured repayment plan, potentially reducing interest rates or eliminating certain fees. Ensure you choose a reputable agency that adheres to ethical practices and has a track record of helping individuals in similar situations.

Negotiating with Creditors for Better Repayment Terms

Consider negotiating directly with your creditors if you prefer to handle your debt consolidation independently. Reach out to them and explain your financial situation. Sometimes, creditors may be willing to reduce interest rates, waive fees, or restructure your repayment plan to accommodate your financial constraints. Remember that not all creditors may be open to negotiations, but it is worth exploring this option.

Managing Your Consolidated Debt

Once you have successfully consolidated your debts, it is crucial to manage them responsibly to achieve long-term financial stability. Here are some tips to help you effectively manage your consolidated debt:

Developing a Realistic Budget

Create a realistic budget that aligns with your financial goals and constraints. Consider your income, expenses, and debt repayment obligations. Ensure that your monthly payments are incorporated into your budget and that you plan to meet them consistently. A well-planned budget will help you stay on track and avoid any unnecessary spending that could derail your debt repayment progress.

Making Timely Payments and Avoiding Late Fees

Ensure that you make your consolidated debt payments on time each month. Late payments attract additional fees and may harm your credit score. Set up automatic payments or reminders to avoid any oversight. Making timely payments demonstrates financial responsibility and gradually improves your creditworthiness.

Minimising New Debt and Improving Spending Habits

Minimising the accumulation of new debt is essential to achieve lasting financial stability. Review your spending habits and identify areas where you can cut back. Consider adopting frugal habits like cooking at home instead of dining out or finding free or low-cost entertainment options. Being mindful of your spending can free up additional funds for your debt repayment.

Regularly Monitoring Your Credit Report and Credit Score

Monitor your credit report regularly to accurately reflect your consolidated debts and their repayment status. Address any discrepancies promptly by contacting the credit reporting agencies. Additionally, keep an eye on your credit score to track your progress and identify areas for improvement. As you make consistent payments toward your consolidated debt, you should see a positive impact on your credit score over time.

Seeking Professional Advice for Any Financial Challenges

If you encounter any financial challenges or have questions regarding your debt consolidation journey, do not hesitate to seek professional advice. Credit finance professionals can provide personalised guidance based on your situation and help you navigate any obstacles. They can also offer strategies to optimise your debt consolidation plan and ensure you stay on the path towards financial freedom.

Benefits and Potential Risks

Effective debt consolidation strategies offer several benefits to individuals tackling large debts. By consolidating multiple debts into a single payment, you simplify your financial obligations and streamline your repayment process. This can lead to reduced stress and improved financial organisation. Debt consolidation can also result in lower interest rates and monthly payments, potentially saving you money in the long run. Moreover, as you make consistent payments towards your consolidated debt, you demonstrate financial responsibility, positively impacting your credit score and improving your overall creditworthiness.

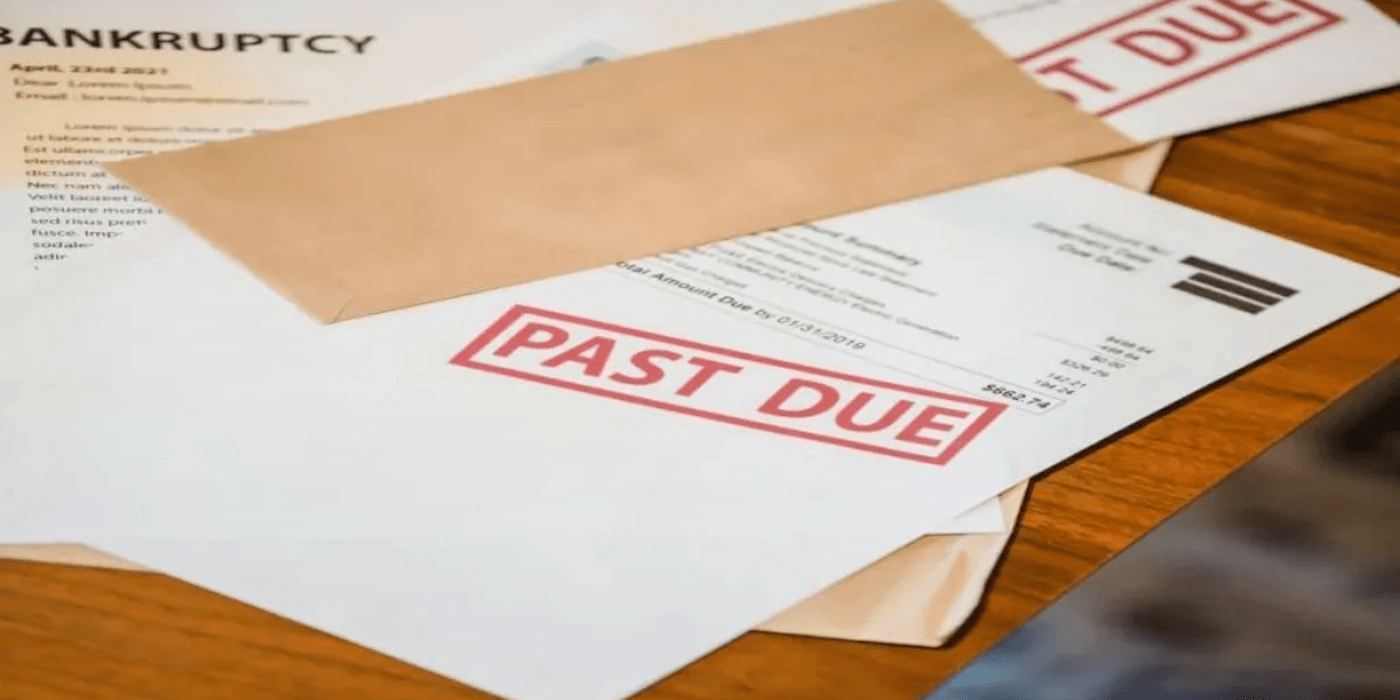

However, it is essential to be aware of potential risks and drawbacks associated with debt consolidation. One common pitfall is the temptation to accumulate new debt once the old debts are consolidated. This can lead to a never-ending cycle of debt and hinder your progress towards financial freedom. Additionally, certain consolidation options may come with high fees or interest rates, reducing the overall savings you can achieve. Lastly, consolidating your debts may have a short-term impact on your credit score, as it involves opening new credit accounts and closing existing ones. However, your credit score can recover and improve with responsible management and timely payments.

Conclusion

Effective debt consolidation strategies can give Australians a practical and manageable approach to tackling their large debts. You can take control of your financial future by understanding the concept of debt consolidation, assessing your debt situation, and creating a well-planned consolidation strategy. Implementing debt consolidation strategies, managing your consolidated debt responsibly, and seeking professional advice when needed will further support your journey towards financial freedom.

Remember, debt consolidation is not a one-size-fits-all solution, and it is crucial to consider your circumstances before proceeding. With determination, discipline, and a proactive approach, you can overcome your debts, regain financial stability, and pave the way for a brighter financial future.

We at Driva help Aussies to navigate the path of a debt-free living by providing debt consolidation loans. Driva built a network of 30+ lenders that Aussies can choose from to find their perfect loan match within minutes. Worry less by choosing us for your loan; we value and provide 100% rate and fee transparency.

.png)