Line Of Credit Vs Loan - What’s The Difference?

.png)

As you know there are many ways people borrow money to meet their financial needs. In this article, we will specifically discuss two of the most popular methods to borrow for individuals looking to finance a large purchase.

We'll cover lines of credit and loans, how they work, and their advantages and disadvantages. Both options can be useful for individuals and businesses looking to access funds quickly and easily, but it's important to understand some key differences that can affect how they are used and repaid.

What is a line of credit?

A line of credit is a type of credit facility that allows you to withdraw funds up to a specific amount, known as the credit limit.

As the borrower, you can borrow money and make repayments at any time you choose, and withdraw again as needed, giving you flexible access to funds.

This type of borrowing is generally offered by banks, credit unions, and the popular 'buy now pay later' (BNPL) platforms like Zip, Humm and Afterpay.

What is a loan?

A loan or personal loan is the more traditional method that you're probably familiar with. It is a one-time lump sum of cash that is borrowed and must be repaid in full, with interest, over a set period of time. This type of borrowing is also offered by banks, credit unions, and other specialist lenders such as car financers and home lenders.

How do they work?

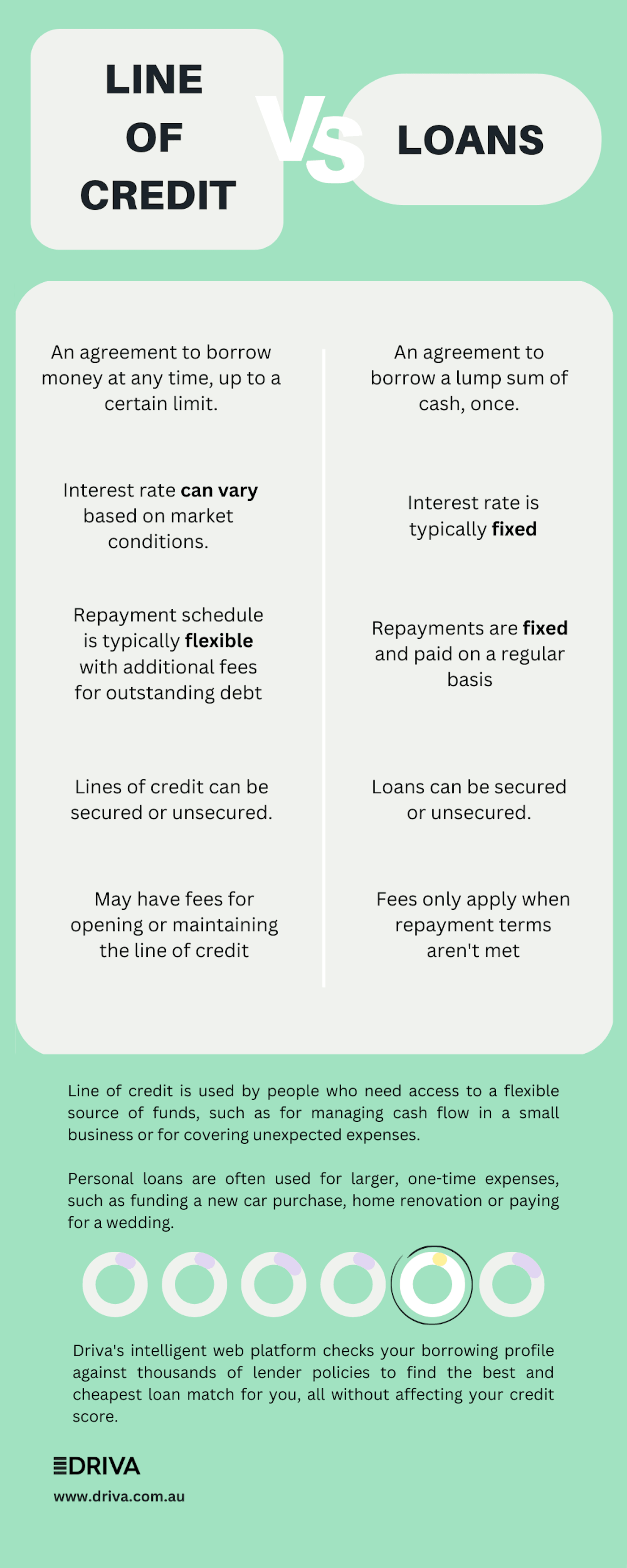

So, you may be wondering what exactly the difference is between the two and how they work? It will be helpful to understand and compare using the following four key attributes of borrowing money. These are the principal amount, interest rate, repayment terms and security. Let's briefly break these down:

The principal

The principal amount is the total amount of money that you borrow. With a line of credit, you have the flexibility to borrow only the amount of money that you need at any given time, up to the maximum limit of the line of credit. With a personal loan, on the other hand, you receive a fixed amount of money upfront that you must repay over time and pay interest in addition.

Interest rate

Interest is the amount of money that you must pay, in addition to the principal amount, as a fee for borrowing the money. Interest rates can vary depending on a variety of factors, such as your credit score and the lender's policies.

Generally, a personal loan has a fixed rate, meaning that the rate remains the same throughout the life of the loan. Line of credit, on the other hand, typically has a variable interest rate, meaning that it can change over time based on market conditions.

Repayment terms

The repayment terms refer to the length of time that you have to repay the loan, as well as the specific payment schedule. Personal loans typically have fixed repayment terms, with a set number of monthly payments over a specific period of time.

With a line of credit, you have more flexibility in terms of repayment terms, as you can choose to make minimum monthly payments or pay off the remaining balance in one lump sum. This often means that the lender will require you to pay interest rates higher than the average loan rate, in exchange for flexible terms.

Security

The concept of security refers to the collateral that you must provide in order to secure the loan. Collateral is a valuable asset that you pledge as a guarantee that you will repay the loan. If you fail to repay the loan, the lender may be able to seize the collateral in order to recoup their losses.

Small credit line providers like Credit cards and BNPL lenders such as Afterpay often offer unsecured lines. They do not require you to secure your borrowed amount since the credit limit is typically low.

Higher credit limits will have more stringent requirements to secure the agreement. Personal Loans such as secured car loans or home loans require you to provide collateral, although many banks/lenders do offer unsecured loans along with a higher fixed interest on the repayment.

By understanding the four key attributes of borrowing money, you will be able to select the option that best suits your needs. You should also be sure to compare lenders and consider the fees, charges, and other costs associated.

This is where Driva can help, we match you with multiple loan options from a range of 30+ Aussie lenders. Our intelligent web platform checks your borrowing profile against thousands of lender policies to find the best and cheapest loan match for you, all without affecting your credit score.

Which one is right for you?

Should you get a loan or open a line of credit? Well, it really depends on your financial situation and what you need the cash for.

In summary, a line of credit may be more suitable for someone who needs flexible access to funds and can manage their spending and repayments effectively. A line of credit works best for those with less-than-perfect credit or for those who need more flexible repayment options. The most common reasons for opening a line of credit are business expenses, home renovations, car servicing, etc.

However, with flexible terms comes the responsibility to manage your spending and ensure that you repay your borrowed amount regularly in order not to rack up additional fees and pay too much more than the principal as interest rates fluctuate over time.

Alternatively, a loan is a great option for those with a good credit score looking to make a large purchase. Loans are particularly useful for purchasing new cars, homes or starting a business.

If what you need is a specific amount to borrow and you can commit to making fixed repayments over a specific period of time; a loan will allow you to lock in a reasonable rate and plan your financial future more easily.

How to apply

Once you are clear on the type of loan you need, take the time to look at your credit score, income, expenses, and any outstanding debt you may have. It's wise to have a clear plan for how you will use the loan or line of credit, and how you will make the required payments. It is also helpful to have any relevant documentation, such as your ID and proof of income, to support your application.

When you have all of these in place, it is time to start searching for the best lender! While this can be a daunting task, Driva’s smart loan tool can help you quickly and easily compare different loan options from a range of lenders without having to fill out multiple applications.

When you have all of these in place, it is time to start searching for the best lender! While this can be a daunting task, Driva’s smart loan tool can help you quickly and easily compare different loan options from a range of lenders without having to fill out multiple applications.

Now you should have everything necessary for your next big purchase, ready to get started? Or if you're just curious about your loan potential? Try our Personal Loan Calculator for personalised quotes.

.png)