Find the best Townsville Car Finance rate in minutes

Join thousands of Townsville customers who have used Driva to find their best loan options.

Instant & personalised

No impact on credit score

No hidden fees

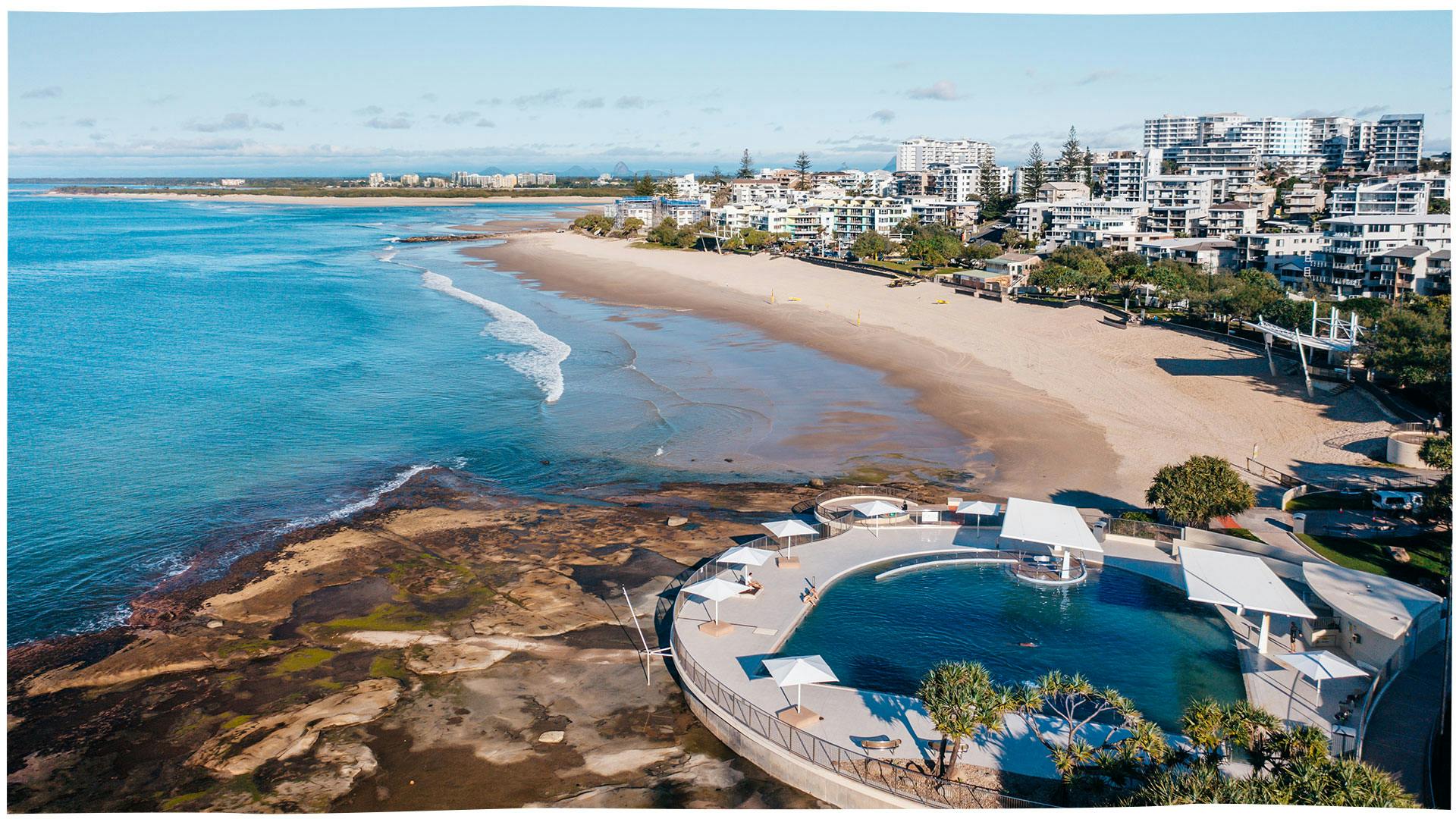

We know car finance just as well as we know Townsville!

Talk to one of our team

Give one of our friendly team a call during business hours on 1300 755 494

Send us an email

You can email us at contact@driva.com.au or start a live chat session.

Get a quote in minutes

Let us know a few quick details and we will provide you with a personalised quote.

Compare loan rates from over 30 lenders

| Lender | Loan Amount | Loan Term | Interest Rates From | |

|---|---|---|---|---|

| $5,000 - $150,000 | 2-7 years | 6.99% p.a. | Find my rates |

| $5,000 - $80,000 | 3-7 years | 7.87% p.a. | Find my rates |

| $5,000 - $100,000 | 2-7 years | 9.15% p.a. | Find my rates |

| $3,000 - $100,000 | 2-7 years | 9.24% p.a. | Find my rates |

| $5,000 - $150,000 | 1-5 years | 9.52% p.a. | Find my rates |

| $5,000 - $130,000 | 1-5 years | 9.69% p.a. | Find my rates |

| $10,000 - $100,000 | 2-5 years | 9.95% p.a. | Find my rates |

| $5,000 - $65,000 | 3-7 years | 10.09% p.a. | Find my rates |

| $10,000 - $100,000 | 3-7 years | 10.25% p.a. | Find my rates |

| $5,000 - $100,000 | 1-5 years | 10.25% p.a. | Find my rates |

| $15,000 - $100,000 | 2-7 years | 10.29% p.a. | Find my rates |

| $2,000 - $75,000 | 1-7 years | 13.95% p.a. | Find my rates |

| $2,000 - $40,000 | 2-5 years | 15.75% p.a. | Find my rates |

Don’t take our word for it

We always recommend a second opinion. Read our customer reviews.