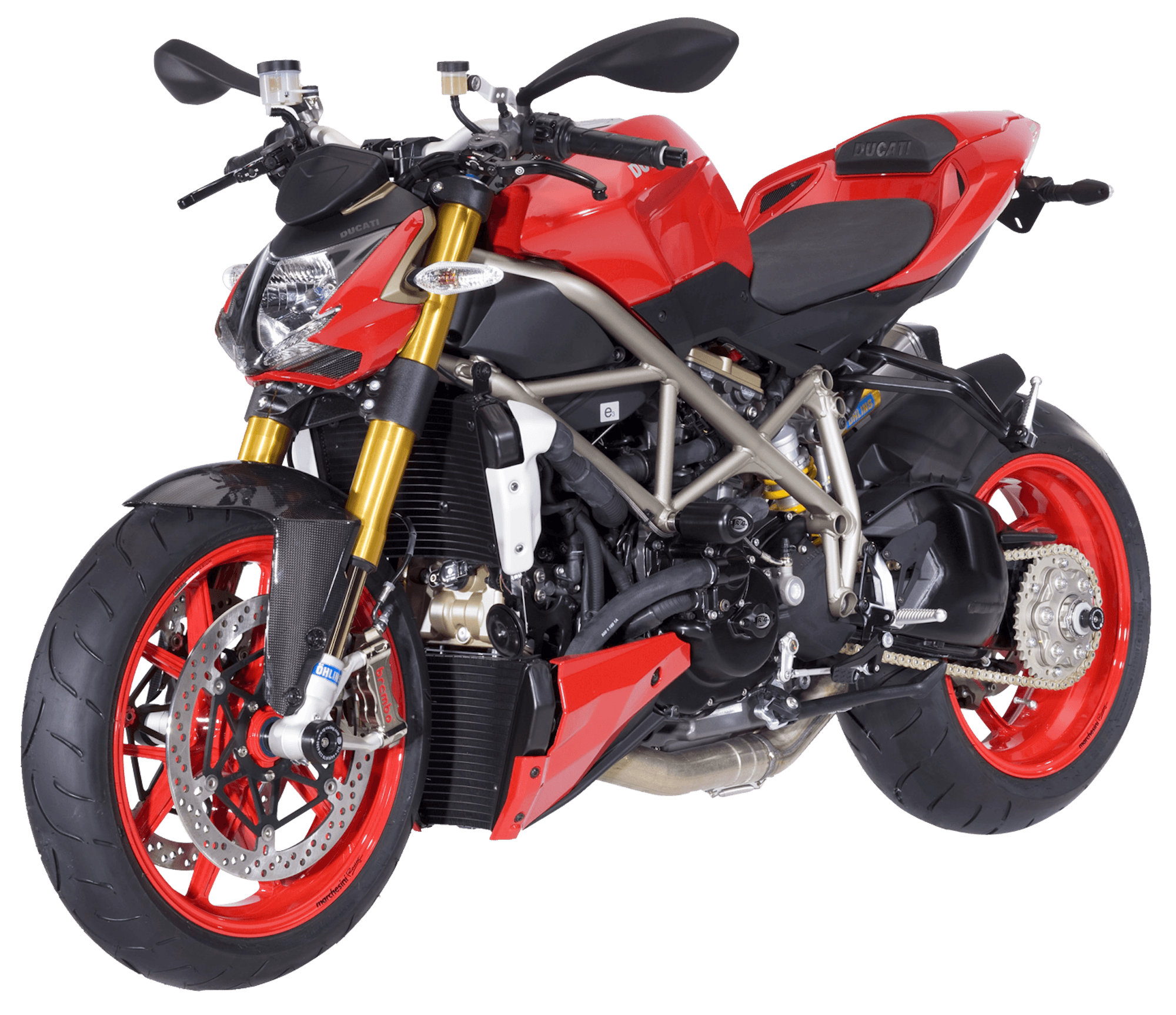

Find your best Ducati finance rate with Driva

Compare 30+ lenders before financing your new motorbike.

Founded in Bologna, Italy in 1926, Ducati has built a reputation for building quality motorcycles with iconic designs. Though they can cost more on average when it comes to maintenance costs, they produce some of the most sought-after bikes in the world, and have been referred to as the ‘Ferrari of motorcycles’.

Whether you’ve got your eye on the beginner-friendly Scrambler Sixty2, or are a seasoned professional and looking for an iconic Hypermotard 950, Driva can help you find your best Ducati finance options.

Bike & personal details

Give us the details of the bike you’re looking at and your personal profile

Loan match

We check your profile against thousands of lender policies to find your matches. No impact on credit score!

Get approved

Approval can take anywhere from 2 hours to 2 days depending on which lender you’ve chosen.

Pick up your motorcycle!

The fun part. Search private sales and dealerships - or ask Driva to match you with a dealer!

Learn more about Ducati motorcycle finance

Don’t take our word for it

We always recommend a second opinion. Read our customer reviews.

Looking for something else?

Have a question?

Ready to get started?