Find your best Suzuki Motorcycle finance rate with Driva

Compare 30+ lenders before financing your new motorbike.

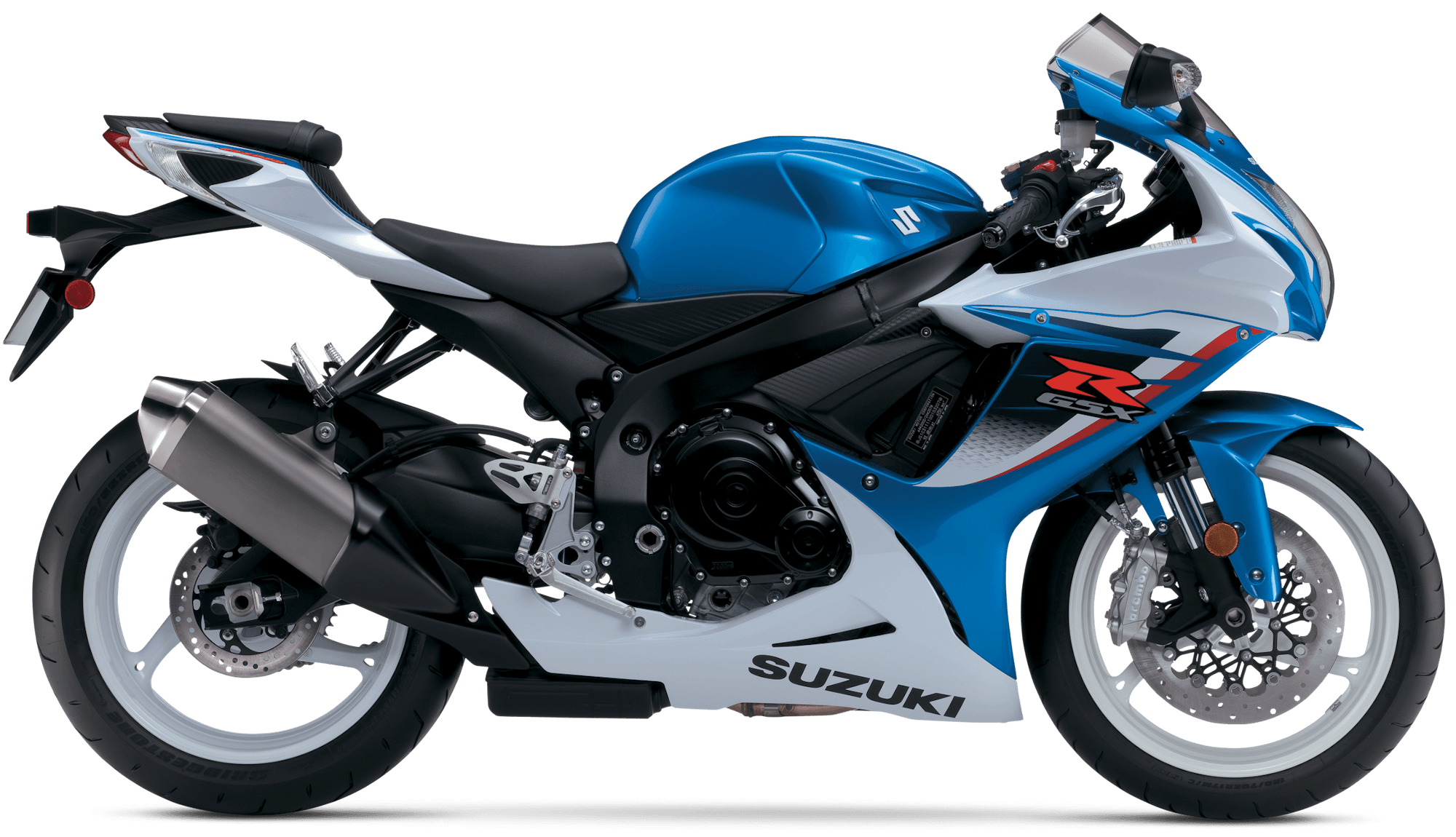

Headquartered in Hamamatsu, Japan, Suzuki manufactures a range of vehicles including automobiles, all-terrain vehicles, and, of course, motorcycles. Suzuki has a reputation for producing quality motorcycles that are as popular amongst beginners as they are amongst seasoned pros.

If you’re after a reliable, high-performance motorcycle, Suzuki could be a great option for you. Driva can help you compare your most competitive rates from our panel of more than 30 lenders, so you can be confident that you’re getting the best possible deal.

Bike & personal details

Give us the details of the bike you’re looking at and your personal profile

Loan match

We check your profile against thousands of lender policies to find your matches. No impact on credit score!

Get approved

Approval can take anywhere from 2 hours to 2 days depending on which lender you’ve chosen.

Pick up your motorcycle!

The fun part. Search private sales and dealerships - or ask Driva to match you with a dealer!

Learn more about Suzuki Motorcycle finance

Don’t take our word for it

We always recommend a second opinion. Read our customer reviews.

Looking for something else?

Have a question?

Ready to get started?